Accelerating Organic Growth:

Five trusted approaches to boosting sales

Five trusted approaches to boosting sales

GROWTH, RECONSIDERED

For too long, too many businesses have acted on an unhelpful myth: build it and they will come. Rather than focusing their efforts on selling well, often they fixate on developing a great set of products and services, assuming that sales and organic growth will take care of themselves. This couldn’t be further from the truth. Turning your focus away from sales risks revenues and the opportunity to make efficiencies, and, ultimately, will have a negative impact on the bottom line.

It is perhaps understandable that businesses do this. Developing a new product or service creates a buzz and an energy that attracts the creative minds within a business that others want to coalesce around. The successes of businesses such as Apple, Netflix, Google and Tesla, with their seemingly always-on approach to product development, may have led us to over-value innovation. Too many companies want to be disruptors, in a narrow sense of that word.

Of course, quality of product and service is important. But in our rush to embrace innovation over all, businesses are paying the price for distraction. They need to recognise that most markets in today’s economy are hyper-competitive, busy and generally overcrowded. Not only does this mean more bargaining power for the customer, it means products and services will tend to be similar. Across most markets, innovation is constant, never-ending and accelerating. So, the minute a business thinks it has a marvellous new idea, 20 competitors will appear with something similar.

Innovation will rarely, if ever, make up for the revenue loss caused by a broken sales channel. The truth is that even mediocre products, properly positioned in appropriate channels, will do better than innovative products poorly sold. If the gold standard is a great product brilliantly sold, if forced to choose one over the other, the focus should be on the latter rather than the former.

In a world where markets are overcrowded, businesses need a sales and marketing machine able to capitalise on innovations and fully realise a return on any investment in product or service development. Because the workings of this machine tap into know-how tested over decades, it is incredibly easy to engineer. You just need to know where to look and what to look for.

This report explores how to accelerate organic growth through the adoption of better sales processes. As well as drawing on our own experience of working with senior leaders, this report is based on the insights gathered directly from over 70 executives and CEOs. The report focuses on how to improve sales strategy; a framework for growth that brings together all the parts of a business; and pinpoints the key areas where even already-successful companies need help.

Matt Crabtree

Founding Partner, Positive Momentum

Premium Credit

Ascential

SD Worx

Companies that want to boost revenues organically should think about:

POTENTIAL

The value of addressable market size, ambitious targets and supportive budgets

PROPOSITION

How innovation and an understanding of customer value should affect pricing

PROMOTION

The power of showcasing a product to the correct audience, using effective channels

PEOPLE

Engineered rewards and continuous development to drive staff satisfaction and purpose

PROCESS

Using data to monitor customers and the productivity of sales teams

20%

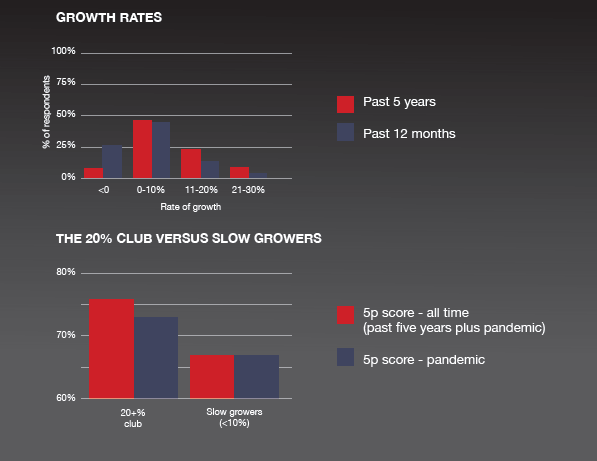

Companies that saw year-on-year growth of 20% or more before and during the pandemic use the 5Ps to a greater degree than companies that saw below 10% growth in the same time.

In particular, the 20% club was markedly better at the promotion, process and proposition aspects of the 5Ps. Doing so appears to have been a hallmark of organic growth success during the pandemic.

Nearly all companies know their basic and current market needs, and approximately one third of businesses rely on the general market awareness of staff. At a minimum, a business that has survived over time will have spoken to customers, judged appetite for a product and gauged some kind of gut-feel or anecdotal sense of where demand lies and what direction pricing should take.

But market demands change over time, whether it is due to the economy, regulation or the development of new products. So it makes sense that businesses try to test the likely future needs of their markets beyond the short term, but our research suggests that more than 40% of companies do this by relying on the general market awareness of staff. This figure is too high. We recommend looking beyond a minimum of three years, but this will depend on market and company specifics. Overlaid with the impact of megatrends such as ESG, and accelerating technological, socio-economic and demographic change, diversity and inclusion, this information will paint a truer picture over time. Building a picture of what the market may demand in future also helps a company balance the list of potential customers with existing customers – an exercise that needs constant review.

But potential isn’t just about knowing the customer and what to serve. Competitor analysis is key and most companies engage in this at a minimum. Those that excel set themselves the task of reviewing this information at least monthly, giving themselves the opportunity to meaningfully detect additional market information that comes from outside its own relationships with customers.

Armed with this information, businesses also need to set budgets against their ambitions. Our findings suggest up to half are doing this through setting year-on-year budgets – an approach that is arguably inflexible and crude, leading to slower rates of growth. But this can be supplemented with an approach that lays out “moonshot” numbers – figures that reflect the potential that objectively exists in the market, and helps the company reach its fuller ambitions. Sales ambitions can and should be based on realistic market size, expressed in a credible plan that is based in the percentage of the addressable market. Year-on-year growth of 12% may sound good, but what is truly possible? If a company targets 3% of the market, it might imply 30% growth of their sales revenue.

POTENTIAL IN A CRISIS

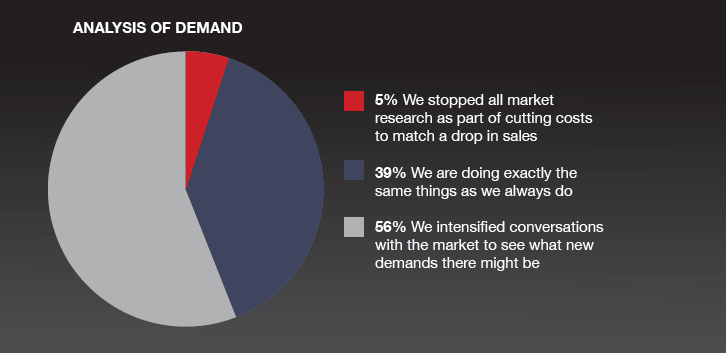

Assessing market potential with which to set new targets remains imperative, even in an economic downturn. In 2020, markedly few companies scaled back seeking new market information.

The 20% club: assessing the market and setting targets

The 20% Club is 1.15 times more likely to use progressive sales targets than companies that see slow growth.

Best 5P behaviours: using moonshot numbers and credible numbers set out in a formalised plan.

When approaching proposition, many companies place too much emphasis on pricing. And 60% of companies in our survey compound this through setting price on current market rates and customer expectations. While price is a salient means of market positioning, companies need to do more than rely on the current success of products and services that are understood and liked in any current marketplace.

As customer demands change over time, so businesses need to match new needs with new products and new pricing strategies. This means innovating and testing new ideas regularly with groups of existing and potential clients. You may think this is a truism, but according to our survey, 19% of companies don’t test new products this way. Ideally, they should copy the 46% that utilise a customer advisory board, which has the freedom to speak freely and criticise a proposed product and service.

Of course, what an advisory board will not tell you is what you should charge for a product – especially if that product is not standardised. Going to market with one price for a bespoke service or product may mean under-charging in some instances, and in others losing business because your customer has chosen a cheaper option. Our data suggests as few as 17% of businesses regularly test elasticity. Instead, businesses need to practise individual pricing: determining the intrinsic value of a product or service to each customer, and then setting price accordingly. This will mean testing price elasticity with each client, but the ultimate result will be higher revenue.

How to approach new ideas? Many businesses innovate because they feel the market says they should, or they simply feel it’s a good thing to do, with as much as 25% indicating this is done just yearly or on an ad-hoc basis. But is this a healthy approach to creativity? The danger of innovating on these terms is that companies become less willing to drop ideas that don’t work and may even fail at spotting great ideas that do. To approach innovation healthily, leaders need to foster a culture of challenge, where failing products are retired regularly, and when new products and ideas are fully tested.

Tara Waite, Group Chief Executive, Premium Credit

About Premium Credit: A provider of insurance premium finance, letting companies spread payments in smaller, monthly instalments.

“When I joined as CEO, we set out a number of growth ambitions aligned to our purpose, to proudly support our community of customers and partners in creating opportunities through convenient payments.

“Relationships play a large part in our markets, but everything we do is technology-reliant. We partner with insurance brokers, insurers and affinities – as well as other third parties – and our technology has to integrate seamlessly with their technology to ensure a good end customer experience.

“We recognise the importance of organic growth and increasing our penetration in our current markets with our existing products by doing things better. We also identified attractive market adjacencies where our proposition would fit naturally. To deliver on both, we’ve invested significantly in technology for our partners and our core systems to fuel this growth.

“But it’s not just about the technology. Our operating model is about stratifying our partners to make sure they get the right kind of service and engagement model from us. That’s why we meet with them regularly to listen to how we are doing and discuss where we can continue to add value and grow our partnerships.”

Our operating model is about stratifying our partners to make sure they get the right kind of service and engagement model from us”

Promotion is often seen as the mainstay of marketing, centred around how products and services are explained and advertised to both existing and potential customers. But the danger is that this is all it ever does. Promotion is in fact fundamental to a company’s wider strategy, whether for the near or long term. Before a company decides to market itself or its products, it needs to be clear on where organic growth originates and the balance between pursuing new sales and retaining business. Part of the answer lies in the size of existing clients – in a B2B context, larger businesses often simply have more money, which budget holders are expected to spend.

With the strategy in place, leaders need to know that how a business treats promotion is a good indicator of its organic growth. Perhaps it’s not a surprise that as many as 30% of companies seek the low-cost approach of using email, social media and basic levels of analytics to measure its success, timed for when there is a new product or service to sell. However, the ad-hoc timing of these efforts is often not specific to the client, thereby risking both new sales and the ongoing conversations needed to gain new customers. Our survey suggests 13% of businesses have an annual digital plan in place, and as many as 57% exploit ongoing, multichannel campaigns that are supplemented with advanced analytics.

So how should companies that want to achieve high rates of growth approach promotion? In terms of timing, promotion needs to be ongoing, meaning multichannel campaigns with live analytics, brought to life with the insights of an automated solution such as Marketo or HubSpot. This allows the business to connect with customers at times when they are ready to pursue a meaningful conversation, whether it is in the run-up to an important industry conference or when they are discussing results with shareholders. Companies also need a view of the customer that includes the lifecycle of that customer from the moment they are identified as being interested in a product, right through to purchase or even a break of a relationship. All of these are opportunities to revive relationships and gather further client-specific information that businesses can leverage.

But none of this will work properly unless resources for promotion are properly organised and channels are managed well. Too many businesses rely on “telephone jockeys”, and pay the price for lacking a multimodal approach. Instead, companies need to select sales channels – LinkedIn, webinars, website SEO – that are digitally optimised through campaigns that wrap around the customer journey and emphasise what is relevant to each. This enables them to analyse channel effectiveness, and with a cost-versus-benefit analysis, build a set of channels that support and boost each other.

The 20% club: excellence in product promotion

The 20% Club is 1.14 times more likely to display forward ways of approaching marketing and promotion than companies that see slow growth

Best 5P behaviours: running a series of ongoing, live campaigns that speak directly to each customer

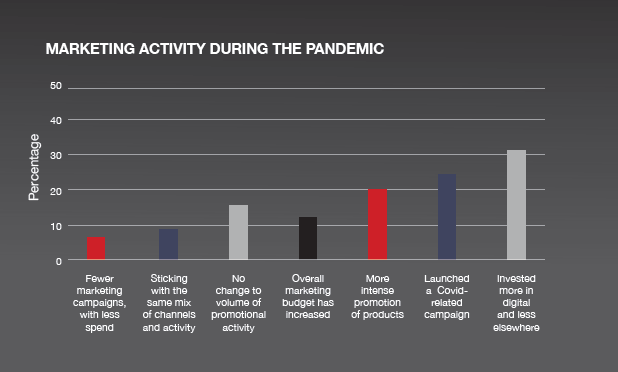

MARKETING THROUGH THE PANDEMIC

With economies on hold, businesses have been faced with a dilemma: scaling back or maintaining marketing activity until the economy improves, or increasing activity in order to increase or maintain market share.

Respect

Acting with uncompromising integrity and treating people with respect to build trust.

Achievement

Being accountable for setting high standards but making continuous improvements that constantly raise the bar within the business.

Challenge

Exploring alternative scenarios, embracing bad news, and leveraging the power of paranoid optimism.

Renewal

Willing to listen and learn, to refine skills, adapt habits, and master how to react to a changing business environment.

This may sound intense and resource heavy, but the point about paranoid optimism is it enables a organisation to move at light speed. Businesses need market information, but once they have it they need to act.

It’s a truism that people play the biggest part in a business, but the importance of talent management with respect to organic growth can’t be overstated. The problem is that many companies assume their approach to people is optimal, including in sales and marketing teams.

Take, for instance, player managers. In stark terms, these are the death of effective leadership, and as many as 30% of our survey respondents reported using them. Often leading teams of two to four people, player managers are created by businesses as a means of ‘progressing’ careers and making people feel valued. But the effects are the opposite. The player manager role creates a dissatisfying experience both for the leader in question, and, typically, the junior staff being managed. It is easy to fall into the trap – the player manager might be a subject matter expert, for instance – but this risks a business with a layer of supervisors. Through merging together micro teams, and identifying strong leaders, companies can better prepare themselves for growth. This entails focusing on that person being a manager of the human resource and becoming an expert leader rather than an expert who leads. What matters is identifying talent, developing it, and allowing leaders to inspire people to motivate them, to provide them with support and instil client-focused ethics at the centre of a sales team. But only 16% of companies in our survey appear to excel at this.

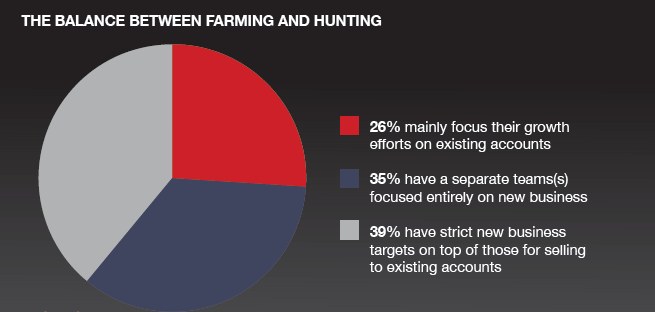

Having leaders focus on their teams means businesses can separate out two fundamental functions of sales: winning new accounts, and growing existing accounts. The categorisation of personalities into introverts and extroverts might be a little crude, but salespeople are typically hunters or farmers. They usually either excel at winning new business or at developing existing relationships – behaviours that boil down to fundamentals about personality. Rarely can they do both.

Of course, none of the above will work with the wrong approach to reward – how much a salesperson can earn, versus their basic salary.

In high-growth sectors and organisations, reward for hitting a sales target may top 100% of salary, which in an era of large basic pay, requires a fuller appreciation from the finance team of what they are paying for. In short, they need to see this set-up as less a cost associated with payroll and more as an investment. As our analysis of the 20% Club shows, there is a correlation between having this mindset and reported growth.

Big salaries and big overrides mean that if a business pays at the top of the market, it will get top-of-the-market people. Rewards that accelerate sharply for hitting above a target and decelerate sharply for missing a target are a means of motivation. The trick is seeing it as an investment, not in what they have done for you, but what they’re going to do to sales growth again and again.

How do you hire an effective team? The trouble is, some salespeople are better at selling themselves in interview than they are at selling a product. Or the energy they used to convince in an interview is lacking on a daily basis in front of customers. But there are some techniques to minimise the risk, including the best of digital assessment. Along with asking what type of sales a person prefers – hunting or farming – potential recruits should do a digital video pitch at first. A three-minute video of why a person thinks they’re a good candidate saves the drawn-out process of applying for jobs and lets the recruiter see more potential hires than wading through CVs.

The flipside to hiring talent is developing it, and in sales and marketing this should not stop at making the salesperson learn the company’s methodology by rote. Staff at all levels thrive when they learn something new, engaging in thought leadership and inviting new ideas into a business, and 48% of respondents to our survey use this strategy. With fields of research such as behavioural selling, data science and AI throwing up insights on a regular basis, personal development is a means of invigorating keen minds and making sure a business makes the most of its intelligence.

The principal means of organic growth suggest too little differentiation of “farmers” and “hunters” – sales teams that cultivate existing accounts, or pursue new clients. These are distinct activities that tap into fundamentally different skills and appeal to divergent personality types.

The 20% club: focusing on rewards

The 20% Club is 1.7 times more likely to adopt high bonuses for sales staff than companies that see slow growth

Best 5P behaviours: rewarding stretch sales growth by at least 100% of base salary

Leaders get bored by process, but by no means should it be overlooked. At its heart is the customer, and the journey they go on when using a product and in all areas when dealing with a business. But more than 27% of businesses fail in mapping a customer journey, and of these, three quarters have recorded less than 10% growth in the past five years. Process should be embedded in an endto- end system that manages a customer from the moment they show interest in an organisation, through billing, service management and support. CRMs are central to this, but they are a tool in a wider exercise and should not be seen as a self-contained solution.

Failure to focus on customers risks revenue. Customers aren’t simply users of a product: they need ongoing support when things go wrong, they may want to know how to get more from a product they have purchased, or they may simply need help with a billing inquiry. So information about this class of interactions need to be managed and at the least put into a customer journey – to make sure that a customer gets the best possible outcome, is persuaded to retain their business and, potentially, shares their positive experiences more widely.

There are many parts to process that a business could analyse, but for organic growth it is imperative to focus on sales methodology – how sellers approach each phase of the sales process, from discussing a customer’s problems and needs to negotiating a price for a solution. Most organisations claim to do this, but in more than 30% of cases, it’s not formalised. Others claim to have a formalised methodology, but “only teach it to the rookies”. But as many as 60% use methodology as their religion, making it spread to each staff member and reinforcing it with culture. Without it, businesses face problems when scaling up. Worse still, they then recruit experienced people who have their own ideas and prejudices, essentially changing process by stealth.

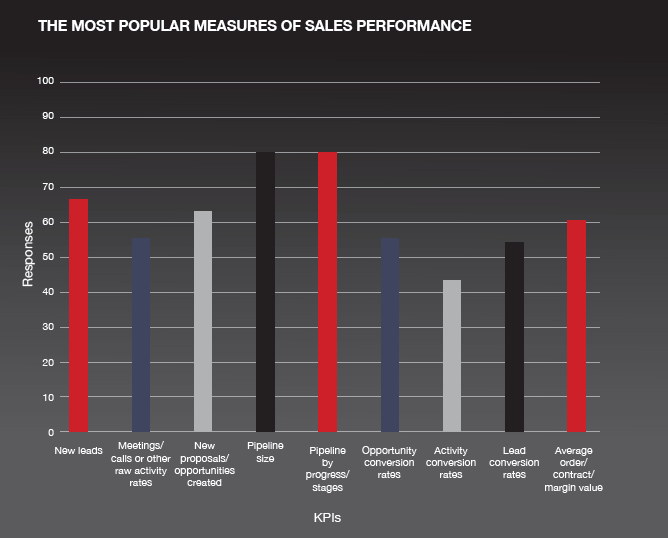

Another invaluable aspect of process is analysing the productivity of the sales team. The problem is that productivity is often mistaken for, or conflated with, performance. In our survey, 70% of respondents assessed sales team activity according to pipeline and monthly performance. Whereas the latter includes measures like percentage of budget or percentage of target, productivity is essentially a test of how efficient a sales machine is at generating outcomes. A rule of thumb to bear in mind: if 30 sellers generate £10m of sales, they would be more productive than a team of 40 that generated the same revenue. Based on performance, they’d be the same. But which would you rather employ? In order to be a truly valuable measure, productivity should also include in-depth measures such as conversion, activity rates and cost of sales, so that leaders can decide if they need to invest in more resource, better training or other sales-enablement tools.

The 20% club: understanding the customer

The 20% Club is 1.41 times more likely to have an effective plan for mapping customer journeys than companies that see slow growth

Best 5P behaviours: detailed map of customer journey, referenced daily

Measuring the effectiveness of sales is key to seeing success, and there are many KPIs to choose from – but too few businesses monitor the productivity of their sales teams.

Each of our consulting partners has deep client-side experience in one or more of our key areas of specialism